Australia’s Property Market – Post The GFC And Through COVID

The unfortunate current COVID pandemic has significantly impacted the Australian property market. Job uncertainty coupled with low business and consumer confidence is naturally playing on the minds of sellers and buyers. But while the length and severity of this downswing are unknown, experts suggest people should take a longer view of property as evidenced by the growth experienced in the decade following the Global Financial Crisis.

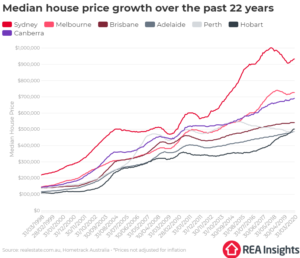

The below has been obtained from REA Insights of realestate.com.au and highlights median Australian capital city price growth between 1998 and 2020 (capturing both the GFC and the beginnings of COVID).

Although historical performance is not a guarantee of future performance, analysis of the above would indicate that prices do tend to go up over time. As such, experts suggest to always seek to hold a long-term view of property by riding through the cycles, as opposed to seeking to pick either the bottom or the top of a market which is incredibly difficult to do so.

Although historical performance is not a guarantee of future performance, analysis of the above would indicate that prices do tend to go up over time. As such, experts suggest to always seek to hold a long-term view of property by riding through the cycles, as opposed to seeking to pick either the bottom or the top of a market which is incredibly difficult to do so.

At this current COVID pandemic stage, there are widespread predictions that in coming months house prices will drop by up to 10% (or even 33% on an absolute downside risk basis). But certainly worth noting that at this stage we are unaware what impacts COVID will have on the property market over the medium to long term. In making their assumptions, experts have had to rely on current known events. As such, they have not included near term future house price prediction scenarios incorporating when international travel will resume that will bring back foreign students to study at Australian tertiary institutions (nearly all of whom rent and their current lack of presence has been identified as a major contributing demand shock for the Sydney and Melbourne CBD investment property markets). The experts too haven’t factored in the period to which the Australian government will seek to ramp back up the skilled VISA program and the like (all individuals when arriving in Australia either have to rent or purchase property creating positive property demand waves).

It is important to remember that current COVID events and reactions are not set in stone and most negative events will not carry medium to long term traction. Both Federal and State Australian governments will return to fiscal stimulus that results in job creation initiatives. Foreign governments will too return to fiscal stimulus which creates potential demand for Australian exports. Unemployment eventually will reduce over time through various micro and macro economic initiatives – and with that Australian consumer and business confidence will return. All create ingredients to boost aggregate demand for housing stock. When demand outstrips supply, prices of any good tend to go up – and vice versa.

It is a widely held view that we are currently not at the top of our property market, as such it may be an opportune time to locate a bargain before the market returns back to normality and potentially heats back up.

Please do not hesitate to contact Spartan Partners if you have any questions with regards to your personal or business property aspirations. Whether you are a first home buying looking to purchase your first established house, build a brand new house, you are existing owners looking to upsize or move, a new or highly experienced property investor, or wanting to purchase the property from which your business operates – we are here to help with technical expertise. Always by your side.